By Ken Goldberg – Consultant, IPWEA FLEET

The results of the IPWEA FLEET Light Vehicle Survey 2020 were recently presented at the Virtual Fleet Management Workshop in November. The survey focused on light vehicle use and replacement amongst other areas of interest. For the purpose of the survey, light vehicles were defined as passenger and commercial (i.e. utilities and vans) vehicles.

There were 42 organisations that responded to the survey, which turned up some interesting and insightful findings. We’ve highlighted below some of the responses in relation to EV ownership and infrastructure, as well as the impact of COVID-19 on light vehicle replacement policy.

Electric vehicle ownership and infrastructure on the increase

There has been a general trend predicted both globally and in Australia towards an increasing move to Electric Vehicles (EVs) in light vehicle fleets. IPWEA FLEET were curious whether this trend would be reflected by our participant organisations. Our findings showed that there hadn’t been much take up to date.

There’s no doubt that many within the fleet community have concerns about a disconnect between existing sustainability policy and reality. However, would these concerns translate to an actual shift in our participant organisations behaviour towards investment in EV’s moving forward? Turns out that the answer is yes.

The survey results for Hybrid EV’s, show that 55% of our participant organisations have at least 1 HEV in their fleet currently. They also report that this number is expected to increase by almost 20% in just the next 12 months. For Battery EV’s, whilst only 17% of our participant organisations currently have at least 1 BEV in their fleet, that number is also expected to increase by a whopping 57% in the next 12 months.

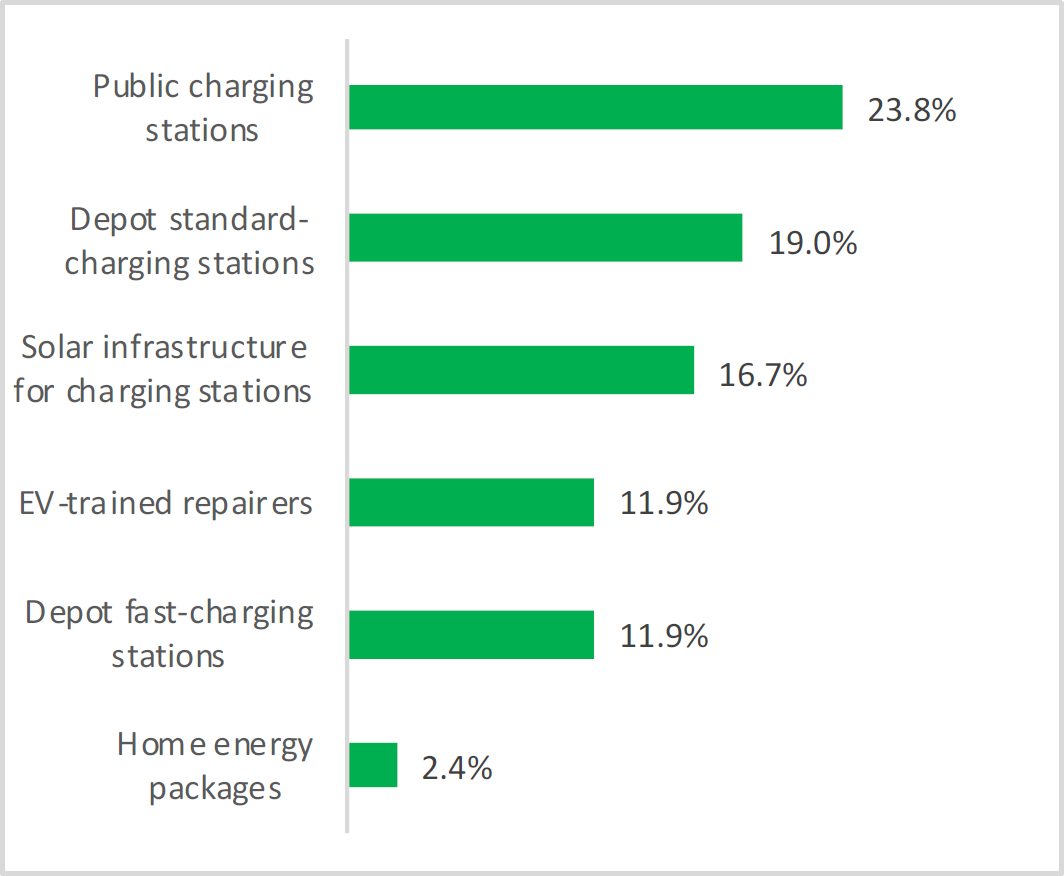

The planned increase in EV’s in our respondent organisations is also supported by their anticipated increase in investment in EV resources and infrastructure over the next 12 months. Some of this increased investment is in depot standard- and fast-charging stations, solar infrastructure for charging stations and in EV-trained repairers.

So, interestingly, both EV adoption and infrastructure investment in our participant organisations are finally squarely in line with an overall general trend towards a greater reliance on EV’s in their fleets.

Impact of COVID-19 on light vehicle replacement policy

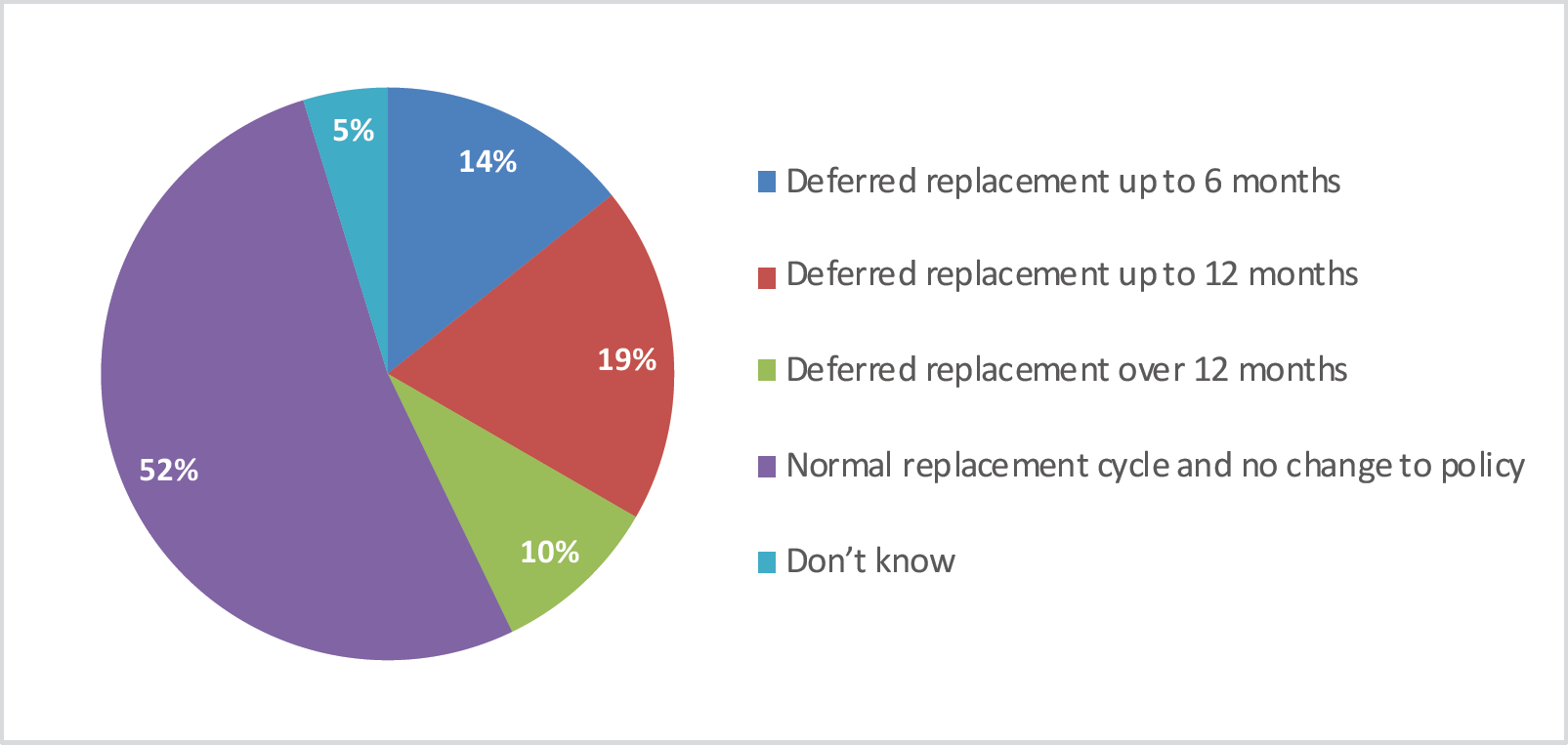

There have been so many facets of life impacted indirectly by COVID-19 and, intriguingly, it seems that light vehicle replacement policies are no exception. A staggering 43% of our respondent organisations deferred light vehicle replacement due to COVID-19. Within that number, 14% deferred replacement for up to 6 months, 19% deferred it for up to 12 months and 10% deferred replacement over 12 months. Of course, the impacts don’t stop there. It is anticipated that there will be other flow-on effects to the fleet industry and vehicle sector generally.

IPWEA FLEET will continue to share more survey findings in subsequent editions of Fleet intouch.